Capitalizing on its shrewd strategy, as well as its competitors’ stumbles, Apple Inc. is set to increase its iPad shipments at a faster rate than previously expected in 2011 and beyond, causing the global media tablet market to exceed growth expectations during the next few years, according to data from analysis provider IHS (http://www.isuppli.com).

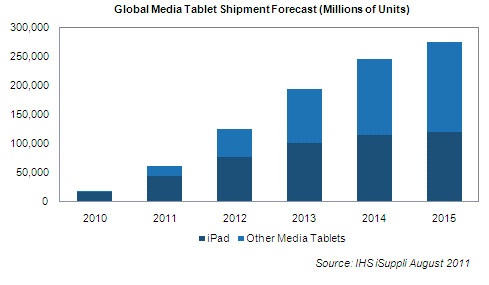

Global media tablet shipments now are expected to rise to 60 million units in 2011, up 245.9% from 17.4 million in 2010. The previous forecast issued in May predicted shipments of 58.9 million for 2011. The new figures will help propel media tablet shipments to 275.3 million units in 2015, compared to the previous forecast of 262.1 million.

“All the momentum in the media tablet market is with Apple right now,” says Rhoda Alexander, senior manager, tablet and monitor research for IHS. “The competition can’t seem to field a product with the right combination of hardware, marketing, applications and content to match up with the iPad. Furthermore, Apple’s patent litigation is serving to slow or complicate competitors’ entry into some key regional markets. With Apple lapping its competitors, many of whom are still struggling to get out of the starting gate, this remains a one-horse race.”

Apple will ship 44.2 million iPads in 2011, up from the previous forecast of 43.7 million. IHS lowered its forecast earlier this year in light of Apple’s initial iPad 2 production and supply challenges. With those supply issues resolved, Apple’s production now is firmly on track to meet the expected strong second-half 2011 demand.

IHS also revised its iPad forecast upward, with shipments expected to reach 120.1 million units in 2015, up from the previous outlook of 97.9 million. Apple is expected to account for 74% of media tablet shipments in 2011 and 43.6% in 2015. This compares to the previous forecast of 64% in 2011 and 32% in 2015. IHS now believes Apple will account for the majority of tablet shipments through the year 2013, one year longer than the previous outlook.

While Apple has deftly played its hand in the media tablet market, its continued dominance also reflects the inability of competitors to mirror the iPad’s success. As a result, IHS has reduced its shipment outlook for alternative tablets at the same time that the iPad forecast was adjusted.

The latest and most dramatic example of the struggles of Apple’s tablet rivals came last week with Hewlett-Packard’s announced exit from the tablet space and instead review opportunities to license its Web OS software to others. The move came just 14 months after HP acquired Palm, whose operating system served as the basis of HP’s tablet product.

Makers of tablets using Android and other operating systems are encountering slower-than-expected sales for their products and facing other challenges, including lagging development of content and applications for their products.

IHS says other savvy moves by Apple in the tablet market in 2011 include its strong marketing and retail expansion not only in China but also other developing economies, as well as the continuing innovation of its tablet platform — a move that has allowed Apple to grab the headlines with reports of strong sales, new applications and compelling content.

What’s more, Apple is still the only tablet player truly benefitting from peripheral advertising, with content providers promoting their iPad-enabled content. The iPad also has profited from being the early favorite in the education space, a factor that will help to boost sales during the third-quarter back-to-school season, says IHS. Finally, Apple is increasing its focus on information technology (IT) support staff, in response to growing interest in its products from corporate markets.

Apple’s run of success is expected to continue though the fourth quarter, with the iPad once again shaping up to be the hot gift of the holiday season. The iPad’s strongest competition may actually come from in-house, with the new iPhone expected to be rolled out this fall, rather than from any of its tablet competitors.

Apple’s tablet sales are expected to get another boost sometime in the first quarter of 2012, with the introduction of the iPad 3, employing the high-resolution Retina display. IHS believes Apple may take a page from the iPhone handbook and offer both the second and third generations of the iPad for a period of time. This would allow Apple to compete on price using the iPad 2 while simultaneously differentiating based on innovation with its new-generation product.

Over the longer term, Apple will benefit from its diversified market strategy that markets the iPad at the consumer, education and corporate segments. This will allow Apple to mitigate the impact of seasonal sales swings in the consumer market, says IHS.

The expansion into China also will boost iPad sales in the first quarter, during the Lunar New Year holiday season. With the first quarter normally a slow sales season outside of Asia, the China sales will serve to smooth out the normal first-quarter sales dip suffered by electronics makers following the Christmas selling season in the West, per IHS.