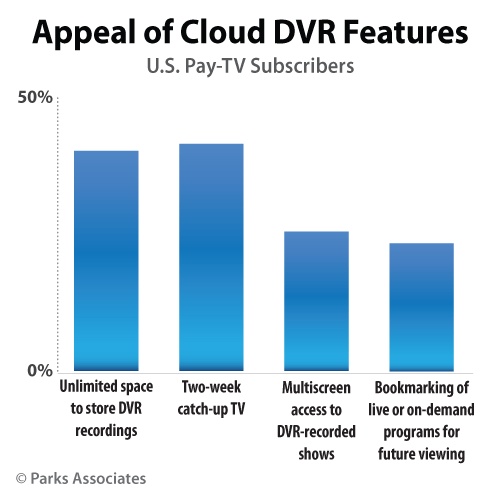

Over 45% of U.S. pay-TV subscribers find cloud DVR technology very appealing, according to new research from Parks Associates (www.parksassociates.com) notes that consumers show particular interest in unlimited storage space and two-week catch-up services for video.

With the Supreme Court omitting cloud DVR in its 2014 Aereo ruling, pay-TV providers can experiment with these cloud services as strategies to build subscriber loyalty and increase revenues.

“The Aereo case left licensing for cloud DVR rights largely unaffected, allowing pay-TV providers to move forward with cloud DVR development and implementation,” says Glenn Hower, research analyst, Parks Associates. “For example, Comcast recently launched in Atlanta its X1 DVR service, which allows, among other capabilities, subscribers to access DVR recordings on their mobile devices. As content owners and providers experiment with cloud technology, the consumers reap the benefits through access to these innovative offerings.”

More than 40% of broadband households in the United States and United Kingdom and over 30% of broadband households in Belgium and France have some kind of DVR. Consumer demand for DVR capabilities remains strong; however, the industry is still grappling with contentious content issues such as storage capacity and duration.

“Acquiring the rights for cloud DVR systems has been a complicated and arduous process,” Hower says. “Many European providers have been extremely diligent in negotiating with content rights owners on cloud DVR, but in the U.S., there is a much greater reliance on statutory and case law. Companies are relying on legislatures and courts to decide the status of rights.”

The U.S. Court of Appeals for the Second Circuit, in its opinion in Cartoon Network v. Cablevision, ruled that cloud DVR technology falls within the scope of fair use under copyright law, effectively allowing cloud DVR to legally exist. It was feared that ABC v. Aereo might overturn the Second Circuit’s ruling, but the Court intentionally excluded cloud DVR technology from its opinion.

“One of the largest concerns with content owners is the possibility of lost advertising revenue that comes with time-shifting content,” Hower says. “These new systems impact almost all aspects of traditional video services, including marketing, licensing, product, and technological strategies. Companies in this ecosystem need to explore new methods to leverage increased viewership from on-demand programming.”