Despite the widespread availability of SVOD [subscription video on demand] services around the globe the U.S. accounted for 43% of SVOD revenues in 2019.

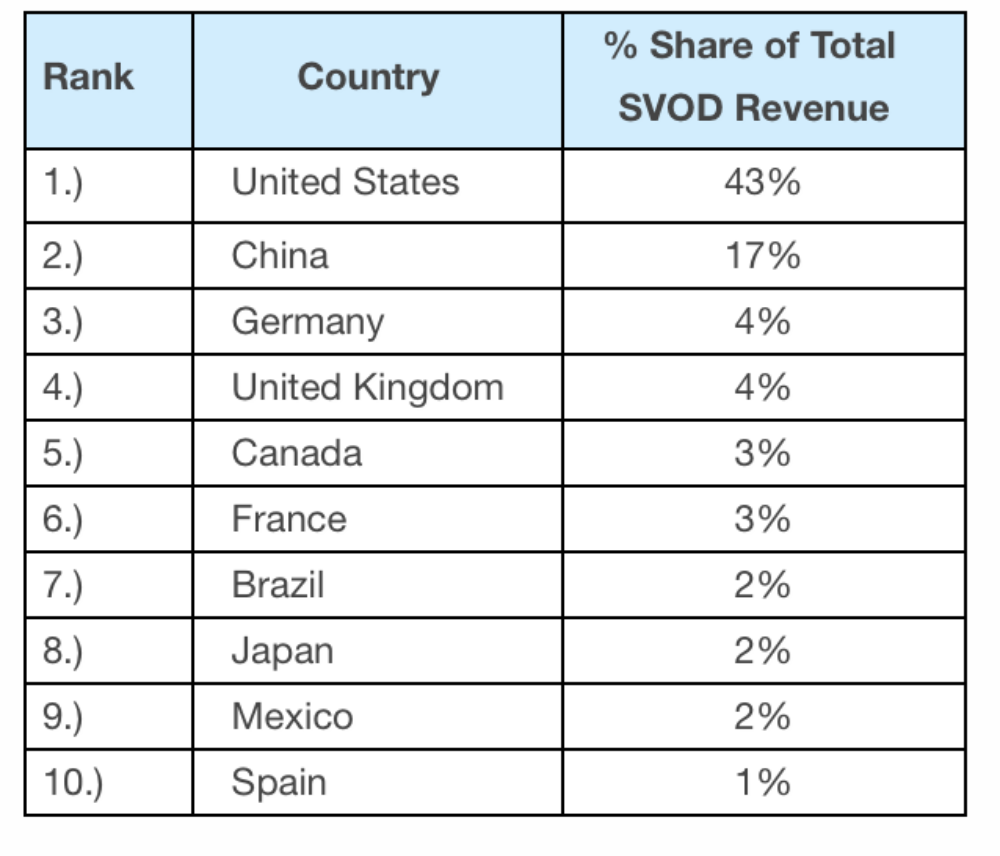

While SVOD services around the world continue to add subscribers at a prodigious rate, revenue continues to be highly concentrated in a few markets. According to Strategy Analytics, TV & Media Strategies (TMS) most recent SVOD forecast “Global SVOD Forecast, by Service (2010 – 2025),” consumer spending on SVOD services globally was US$53.34 billion in 2019. Of this, the U.S. accounted for 43%, followed by China (17%), Germany (4%), and the United Kingdom (4%). Overall, the top ten countries account for 81% of consumer spend on SVOD services.

By 2025, global consumer spend on SVOD services will grow to $102.86 billion, forecasts the research group. Of this, the U.S. will account for 44%, followed by China (15%), and Germany (5%). Factors driving the U.S. dominance of consumer spend on SVOD services include the following.

- While there are a handful of countries that are on par with the U.S., in general, U.S. TV HHs are more likely to subscribe to SVOD services than those in other countries. In 2019, 74% of U.S. TV HHs subscribed to one or more SVOD service. In comparison, the global average was 32%.

- On average, U.S. SVOD HHs are more likely to subscriber to multiple services than their counterparts in other regions. On average, U.S. SVOD HHs subscribed to 2.45 SVOD services in 2019, by 2025 this will grow to 3.21. In comparison, SVOD HHs globally subscribed to 1.54 SVOD services in 2019, by 2025 this will grow to 1.82.

- Lastly, SVOD services tends to be more expensive in the U.S than in other countries, though that can vary by country and service. For example, Netflix is significantly more expensive in Denmark and Switzerland than the United States. Globally, the avg. spend per SVOD service in 2019 was $6.24 (€5.56), in the U.S. the average was 63% higher at $10.22 (€9.11) per SVOD service. Given that each SVOD household in the U.S. subscribes to multiple services they spent an average of $22.52 (€20.08) per month on SVOD services, compared to $9.26 (€8.25) globally.

“Whether it is pay TV, video rental and sell-thru, or subscription VOD, U.S. consumers have historically shown a willingness to spend on these products and services at a far greater rate than those in the vast majority of other countries,” said to Michael Goodman, director, TV & Media Strategies. Goodman added, “there are many local and regional SVOD services around the world, these services must be realistic about the ultimate potential of SVOD revenues and not base their models on U.S. levels of demand.”