An Apple-commissioned report by Kinshuk Jerah, Professor of Business, Marketing Division, Columbia Business School, says the tech giant hasn’t seen any significant financial gains from its App Tracking Transparency (ATT) that debuted last year.

The report, dubbed “Mobile Advertising and the Impact of Apple’s App Tracking Transparency Policy,” is designed to counter accusations that Apple launched ATT to benefit its own advertising business.

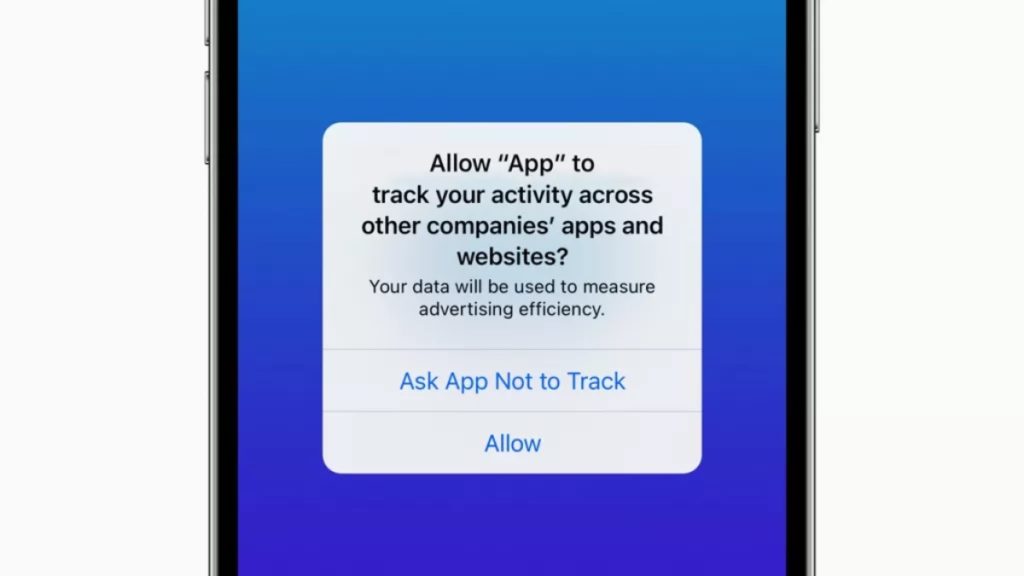

ATT allows you to choose whether an app can track your activity across other companies’ apps and websites for the purposes of advertising or sharing with data brokers. Starting with iOS 14.5, iPadOS 14.5, and tvOS 14.5, apps must ask for permission before tracking your activity across other companies’ apps and websites.

Tracking occurs when information that identifies you or your device collected from an app is linked with information that identifies you or your device collected on apps, websites and other locations owned by third parties for the purposes of targeted advertising or advertising measurement, or when the information collected is shared with data brokers.

Here are some highlights from the report:

° ATT does not affect apps’ ability to collect and use first-party data. Therefore, any company offering effective targeted advertising primarily using first-party data would experience limited, if any, impact of ATT. In fact, any such company would stand to benefit from ATT (not just Apple) as advertisers sought effective ad targeting based on first-party data. It seems unlikely that most of the ad dollars supposedly lost by companies that rely heavily on third-party data (such as Meta) would move specifically to Apple—which according to several third-party estimates accounts for only a small percentage of world- wide mobile advertising—when there are several other alternatives. Indeed, at the current estimated ad supply levels on Apple Search Ads, it seems unlikely that it would be able to absorb billions of dollars of displaced advertising revenue and still deliver effective return on investment to advertisers.

° Second, Apple Search Ads grew for a variety of reasons unrelated to ATT—it is a relatively new entrant in a fast-growing space, certain app categories grew substantially in 2021, and it launched in a large market (China) in 2021.

° Finally, Apple offers users an active choice of whether to turn off personalized ads on Apple’s apps in the form of the Personalized Ads prompt. Users who choose to turn off personalized ads on Apple’s apps would receive only contextual ads. This has the potential to make Apple Search Ads at least somewhat less attractive to advertisers, which calls into question the notion that Apple introduced ATT to attract billions of ad dollars from other companies to Apple Search Ads.

When it comes to ATT, a research paper from the Department of Computer Science, University of Oxford, said that while ATT in many ways works as intended, loopholes in the framework also provided the opportunity for companies, particularly large ones like Google and Facebook, to work around the protections and stockpile even more data. The paper also warned that despite Apple’s promise for more transparency, ATT might give many users a false sense of security.

Article provided with permission from AppleWorld.Today