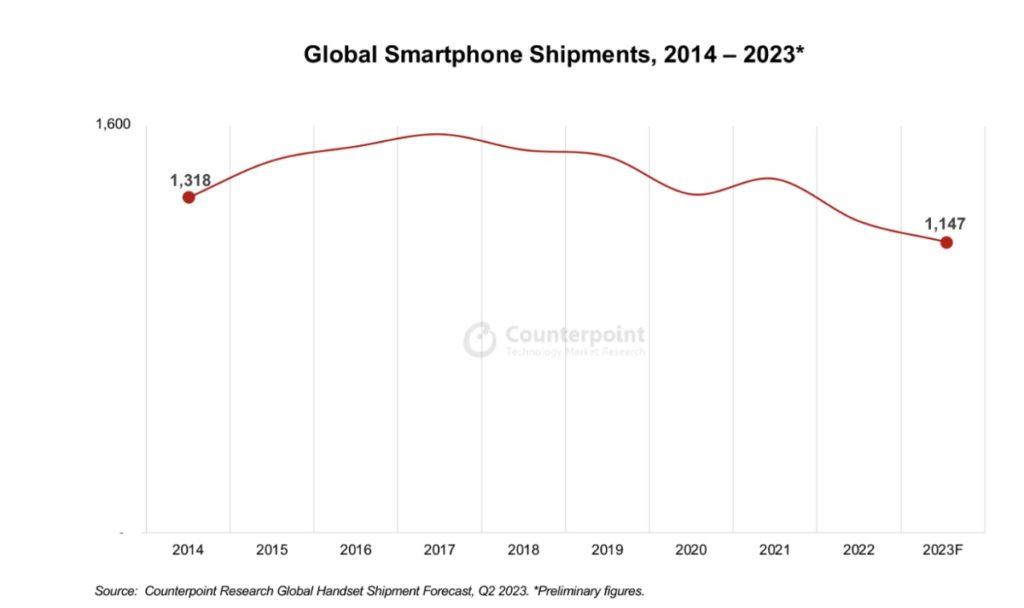

According to preliminary figures from Counterpoint Research’s latest “Global Smartphone Shipment Forecast,” 2023 shipments are forecast to decline 6% to 1.15 billion units, the lowest in a decade.

However, the research group says that Apple is the best positioned among key smartphone manufacturers and could become the #1 brand for first time ever.

“There’s been a decoupling between what’s happening in the economy and consumers buying phones. So far this year it’s been record low upgrades across all carriers,” says Jeff Fieldhack, Counterpoint research director for North America. “But we’re watching quarter four with interest because the iPhone 15 launch is a window for carriers to steal high-value customers. And with that big iPhone 12 installed base up for grabs promos are going to be aggressive, leaving Apple in a good spot.”

In China, “Apple is well positioned as the premium segment continues to gain more share,” adds Ethan Qi, Counterpoint’s associate director for China. Premium and ultra-premium growth is a trend that is happening globally and favors vendors like Apple which have portfolios heavily weighted in the higher segments, he adds.

Counterpoint thinks that 2023 could mark the start of a new era for Apple as a resilient premium market and strong showing in the US could help it become number one globally in terms of annual shipments for the first time ever.

“It’s the closest Apple’s been to the top spot. We’re talking about a spread that’s literally a few days’ worth of sales,” says Fieldhack. “Assuming Apple doesn’t run into production problems like it did last year, it’s really a toss up at this point.”

Counterpoint says that Asia is one of the major hurdles to positive growth, as headwinds halt the economic turnaround anticipated for China at the start of the year, and the broader region experiences intensifying declines across emerging markets. As well, North America continues to be a major drag on global recovery, with a disappointing first half setting it up for double-digit full year declines.

Despite strength in the jobs market and inflation falling, consumers are hesitant to upgrade their devices, pushing replacement rates for the US and globally to record highs, notes Counterpoint.

Article provided with permission from AppleWorld.Today