Canalys research reveals that the smartphone market in India recorded 43.0 million shipments in quarter three (Q3) of 2023, as the market moves toward gradual recovery. And it was kinda good news for Apple.

Canalys says that although there was a 3% year-on-year decline in shipments, the quarter witnessed an improved consumer environment, allowing vendors to capitalize on newly introduced devices. The research group says that Samsung maintained its top position in Q3 2023 with a market share of 18% and a shipment of 7.9 million units.

Xiaomi advanced to the second position, shipping 7.6 million units. vivo dropped to the third spot, shipping 7.2 million units, while realme and OPPO (excluding OnePlus) completed the top five by delivering 5.8 million and 4.4 million units, respectively.

And what of Apple and the iPhone? Although Apple doesn’t rank in the top five India smartphone manufacturers, the premium segment continued to experience robust growth in the country in the third quarter. Canalys says it was driven by Samsung’s S23 series and older-generation iPhones, such as the iPhone 14 and iPhone 13, being offered at attractive deals during the festive sales.

India’s festive season includes Diwali – Festival of Lights (November 12), Nevaratri — the 9-Nights Festival for Goddesses (October 15-24), Navaratri — Victory of Rama (October 24, 2023) and Durga Puja — Victory of Durga (October 20-24).

Of Indian consumers planning to purchase a smartphone this festive season, 31% mention upgrading to the latest technology as the key reason for the purchase according to an October survey conducted by Counterpoint Research.

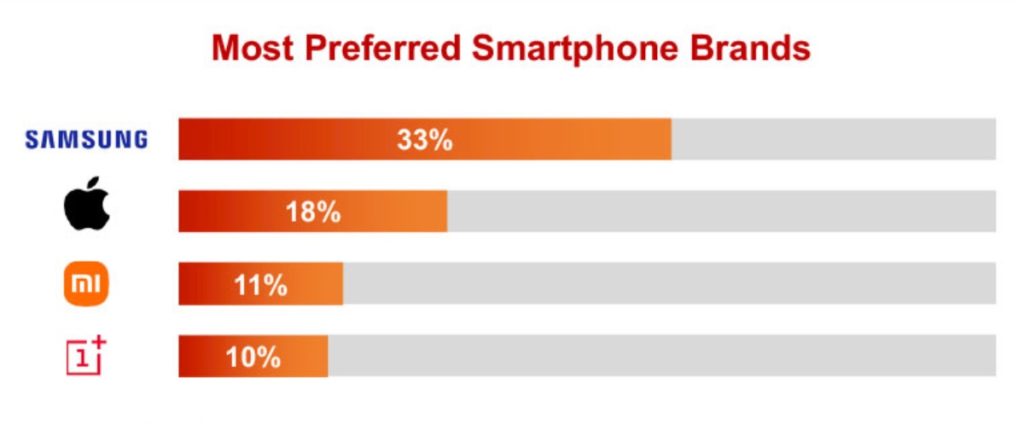

Samsung, Apple, Xiaomi, and OnePlus are the most preferred brands this festive season. They tallied, respectively, 33%, 18%, 11%, and10% as the most preferred brand in the survey.

For 18% of respondents, 5G is the top specification to consider, followed by the latest processor (14%) and RAM (9%). In terms of budget, 42% plan to purchase a premium smartphone (INR 30,000 or ~$360 and above). And with respect to channel preference, up to 86% could purchase via online, with Amazon as the top preferred platform.

Article provided with permission from AppleWorld.Today