Momentum behind tablet (slate) shipments is growing, with a year-over-year increase of nearly 200% to 55.7 million units expected in 2011, according to the “DisplaySearch Quarterly Mobile PC Shipment and Forecast Report.”

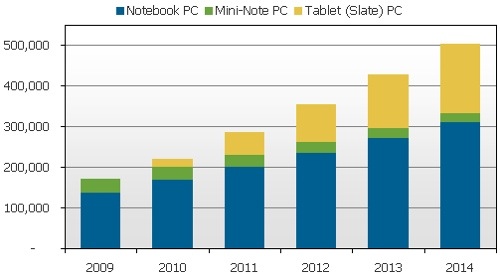

Though growth rates will slow over the forecast period, the slate personal computer share of the overall mobile personal computer market, which also includes notebooks and mini-notes, will rise to nearly 35%, or 172.4 million units, by 2014. Total shipments of the mobile personal computer market are expected to reach 503.8 million units by 2014.

“The upcoming product announcements, introductions and demonstrations in the coming weeks will build on the tremendous momentum that the market has already seen and will lead to segmentation in the tablet (slate) PC market,” says Richard Shim, mobile computing analyst for DisplaySearch. “This segmentation translates to significant shipment growth and proliferation in the short and long term.”

Segmentation is also demonstrated by the numerous screen sizes expected to be supported by the many devices that will become available in 2011. DisplaySearch expects the categories of 7-inch wide, 10-inch standard, and 10-inch wide to be the dominant screen sizes used by new products in the coming years.

When Apple introduced its iPad in 2010, it once again shocked many industry observers by providing a standard (4:3) aspect ratio device, even as notebooks, monitors, and TVs were moving to wide (16:9 or 16:10) formats. The success of the iPad has sparked debates about the best display format for slates; combined with screen size, the outcome of this debate will help to define the category. A plethora of new devices purporting to be more user-friendly by the nature of their “wide” footprint (or “long” when used in the palm of one’s hand) continue to flood the supply chain.

The significant growth of slates is expected to cannibalize the mini-note and notebook mobile PC categories, but this will vary by region. Cannibalization of mini-notes and notebooks by slates is expected to be most noticeable in mature markets where computer penetration rates, meaning percentage of households that already own computers, are highest. In emerging markets, cannibalization is expected to be negligible because computer penetration rates are relatively low as compared to mature markets. Plus, individuals tend to desire more highly configured and more capable first computing devices.

The overall result will be an increase in the mobile computer category. Mobile computer shipment growth is expected to be in the double digit range throughout the forecast period, peaking in 2011, at 30.4% Y/Y, and gradually declining to 17.7% growth in 2014.