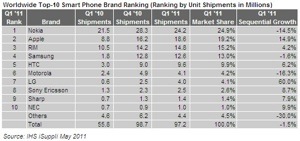

Bucking a rare downturn in the burgeoning smart phone business, Apple in the first quarter achieved double-digit-percentage growth in iPhone shipments and posted the best performance among the Top 5 competitors, new IHS iSuppli (http://www.isuppli.com) research reveals.

No. 2-ranked Apple in the first quarter of 2011 shipped 18.6 million iPhones, up 14.9% from 16.2 million in the fourth quarter of 2010. Apple’s increase represented the highest percentage growth among the world’s Top 5 smart phone brands, with No. 5-ranked HTC coming in a distant second given its 6.2% growth. It also marked a standout performance in a smart phone market that suffered a 1.5% sequential decline in shipments during the first quarter.

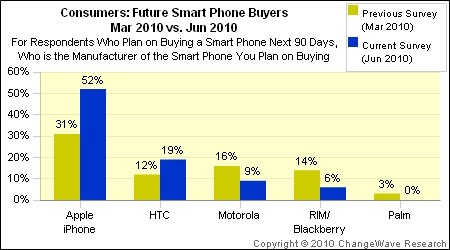

“Apple’s smart phone market share in the first quarter was boosted by the introduction of its first iPhone model with code division multiple access (CDMA) as well as by the addition of Verizon Wireless as a carrier in the United States,” says Tina Teng, senior analyst, wireless communications, for IHS. “Not only did this allow Apple to expand its target market and boost shipments, it also placed additional pressure on rival smart phone brands — including Motorola, Samsung, LG and HTC — that focus on Verizon Wireless as a major customer.”

With its concentration on the U.S. market, Motorola was the one most impacted by Verizon’s addition of the iPhone, a factor contributing to Motorola’s 16.3% decline in shipments in the first quarter.

With shipments from Nokia, the No. 1 smart phone brand, declining by 14.5% during the first quarter, Apple made major strides toward achieving market leadership, according to iSuppli. Apple in the first quarter trailed Nokia by just 5.7 percentage points, compared to 12.2 points in the fourth quarter of 2010.

Nokia’s smart phone shipments declined to 24.2 million units in the first quarter, down from 28.3 million in the fourth quarter. The company’s agreement with Microsoft Corp. to make Windows Phone 7 its principal operating system over the long term is having a negative near-term impact on its smart phone shipments. With the announcement of the deal, Nokia eliminated the incentive for consumers to buy its existing smart phone products, which are based on its Symbian and MeeGo operating systems. Meanwhile, the Microsoft deal is unlikely to yield any products for nearly one year.

The decline in smart phone shipments in the first quarter represents the first sequential decrease since the beginning of 2009. While many electronic products typically suffer a sales slump during the beginning of the year following the peak selling sales season in the fourth quarter, the fast-growing smart phone has been immune to this phenomenon during most years. However, IHS iSuppli doesn’t believe the first-quarter results represent a long-term trend for the smart phone market.

“The reduction of shipments reflects inventory control efforts in the smart phone market, rather than weakening consumer demand,” Teng says. “This decline does not change the IHS iSuppli forecast of 60 percent growth in worldwide smart phone shipments for the entire year of 2011.”

No. 3 smart phone brand Research in Motion (RIM) in the first quarter outperformed the overall market, with its shipments rising by 4.2%. The company benefited from success by expanding sales in regions outside North America. It also capitalized on the trend toward cell-phone-based monetary transactions with the announcement of several smart phone models that integrate near-field communications (NFC) technology. What’s more, RIM continues to appeal to business customers who value the company’s focus on its service package and security as the key selling points, says iSuppli.

Despite RIM’s above-average performance, the company lost ground on the No. 2 smart phone ranking to Apple. RIM in the first quarter trailed Apple by four percentage points, up from 2.1 points in the fourth quarter of 2010.