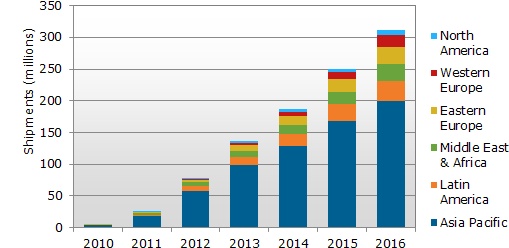

The low-cost smartphone segment, defined as models with a selling price of less than US$150, is a strong growth opportunity for the mobile phone industry, according to the new “NPD DisplaySearch Smartphones: Displays, Designs and Functionality” report. Low-cost smartphone shipments are forecast to double every year from 2010 to 2016, increasing from 4.5 to 311.0 million.

“Most mobile phone subscribers around the world can’t afford to spend more than US$200 for a smartphone, on top of their service plans,” says Shawn Lee, research director at NPD DisplaySearch (www.displaysearch.com). “Low-cost smartphone manufacturers create these new products quickly without much investment, which has allowed them to extend their telecom subscriber base to emerging regions.”

Most of the demand (60%) is from the Asia Pacific region, where a large majority of component suppliers and manufacturing factories are located — providing both time and cost savings. These solutions have a shorter lifetime than high-end smartphones and are manufactured via ready-made solutions from application processor manufacturers. The product mix is complex, requiring continuous development cycles for new products, according to DisplaySearch.

To keep prices low, the key requirements for components are low cost and readily available supply. Android is the most popular operating system for low-cost smartphone designs because it is open source. Brands and manufactures tend to use mature, low-price components, rather than developing new ones. For the display, this means standard a-Si TFT LCD rather than high-resolution LTPS.

The penetration rate of Android-based low-cost smartphones is increasing, with NPD DisplaySearch forecasting their share to grow from 2% of total smartphone shipments in 2012 to 29% in 2016. Local brands and “white box” vendors in China have taken an aggressive stance in capturing market share.