Research from Parks Associates (http://www.parksassociates.com) finds over 40 million U.S. consumers, or 20% of all smartphone users, used at least one mobile proximity or mobile e-commerce wallet in 2013, and usage will increase to nearly 113 million, or 43% of all smartphone users, by 2017.

“After years in development, the mobile wallet market is making progress towards viability,” says Jennifer Kent, senior analyst at Parks Associates. “Mobile wallet apps exist at the intersection of marketing and payment, and because of this unique position, they are valuable and insightful tools for merchants and advertisers.”

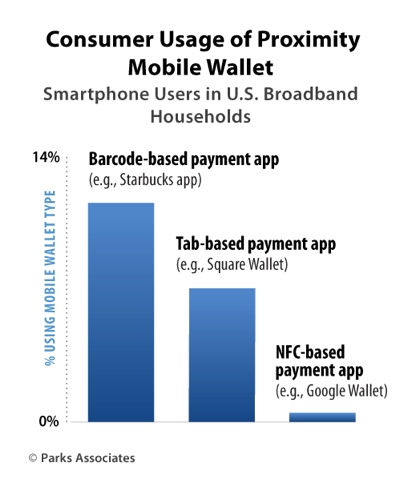

Previously, market watchers used the success or failure of NFC as a barometer for the potential of the mobile wallet market, but barcode-based apps, not NFC, dominate current in-person use, she added. However, with the rise of barcode, cloud, and Bluetooth-based wallets, the mobile wallet market no longer depends so exclusively on one technology.

“This diversification, while messy for the consumer, will help developers and industry stakeholders hone in on the best value propositions for both consumers and merchants,” says Kent.

Research from Parks Associates shows nearly 50% of holiday CE [consumer electronics] shoppers in 2013 planned to use their smartphones while shopping. Among CE shoppers, 35% planned to use their smartphones to look up product information, while 31% planned to use mobile apps for holiday shopping.

“We saw mobile apps and social media play an increasingly important role in holiday shopping, with almost one in two holiday CE shoppers using their smartphones as part of the shopping process,” Kent said. “More than 38% of those planning to spend $1,000 or more were using mobile apps for holiday shopping.”

Even as the technology ecosystem diversifies, Parks Associates analysts expect that consumer demand will push the market for mobile wallets to consolidate in other areas.

“Stand-alone mobile wallet services, such as P2P funds transfers and coupon/receipt storage, will become incorporated into full-featured wallet apps,” Kent said. “Additionally, proximity and e-commerce wallets will become less distinct as consumers will expect to access their payment credentials stored in their wallet apps whether they are shopping in-person or online.”