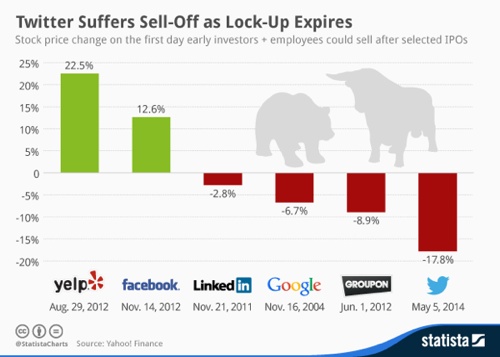

When a company goes public, early investors and company insiders are usually forbidden to sell their shares for a predetermined amount of time. When this so called lock-up period, usually 90 to 180 days long, expires and trading restrictions are removed, stocks typically fall as early investors are keen to cash in on their investments.

The latest company to suffer such a sell-off is Twitter. On Tuesday, the company’s lock-up period expired and despite prior claims of major shareholders not to sell, the company’s stock price dropped like a rock during Tuesday’s trading. At the end of the day, the stock had slipped almost 18% to close at an all-time low of US$31.85.

No rule comes without exceptions though: In November 2012, when millions of Facebook shares became eligible for trading, many had expected the stock to take a nose dive after its rocky start to public trading. In the end the opposite happened: Facebook’s shares climbed 12.6% marking the starting point of a rally that saw Facebook double its value within the next 12 months. The chart is courtesy of Statistica.com