A new study from Juniper Research (www.juniperresearch.com) has found that the value of consumer spend on remote payments for digital and physical goods will surpass $3.3 trillion this year, up 10% on 2017’s total of $3 trillion.

The research group says alternative payment mechanisms would comprise an ever increasing proportion of online spend. PayPal already accounts for 20% of mobile and online physical goods transactions made outside China, while the success of Alipay and Weixin Pay within China means that these two players combined now account for 45% of global payment volumes.

The research also highlighted the major pain points for merchants and consumers. Juniper says European merchants needed to be aware of the implications of PSD2 on card-on-file, meaning they would need to be ‘white-listed’ by consumers for payment details to be stored. Indeed, CA (Secure Customer Authentication) obligations could potentially adversely impact on conversion rates by increasing friction at checkout, according to Juniper.

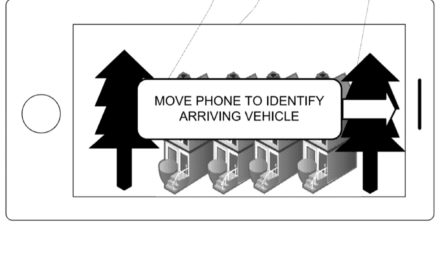

The research claimed that retailers were struggling to resolve issues around customer identification within the broader commerce framework. As research author Dr. Windsor Holden pointed out,

“Payment processors and other key stakeholders need to work closely with merchants to ensure they can recognize individual consumers, regardless of device and whether they are purchasing online or offline, to deliver the optimal experience across the retail lifecycle,” he said.

What’s more, Juniper stressed that not only should merchants localize supported payment mechanisms (such as iDEAL in the Netherlands and credit card installments in Brazil), but also the entire payment flow. It recommended they work with payment processors to test optimal flows for target markets.