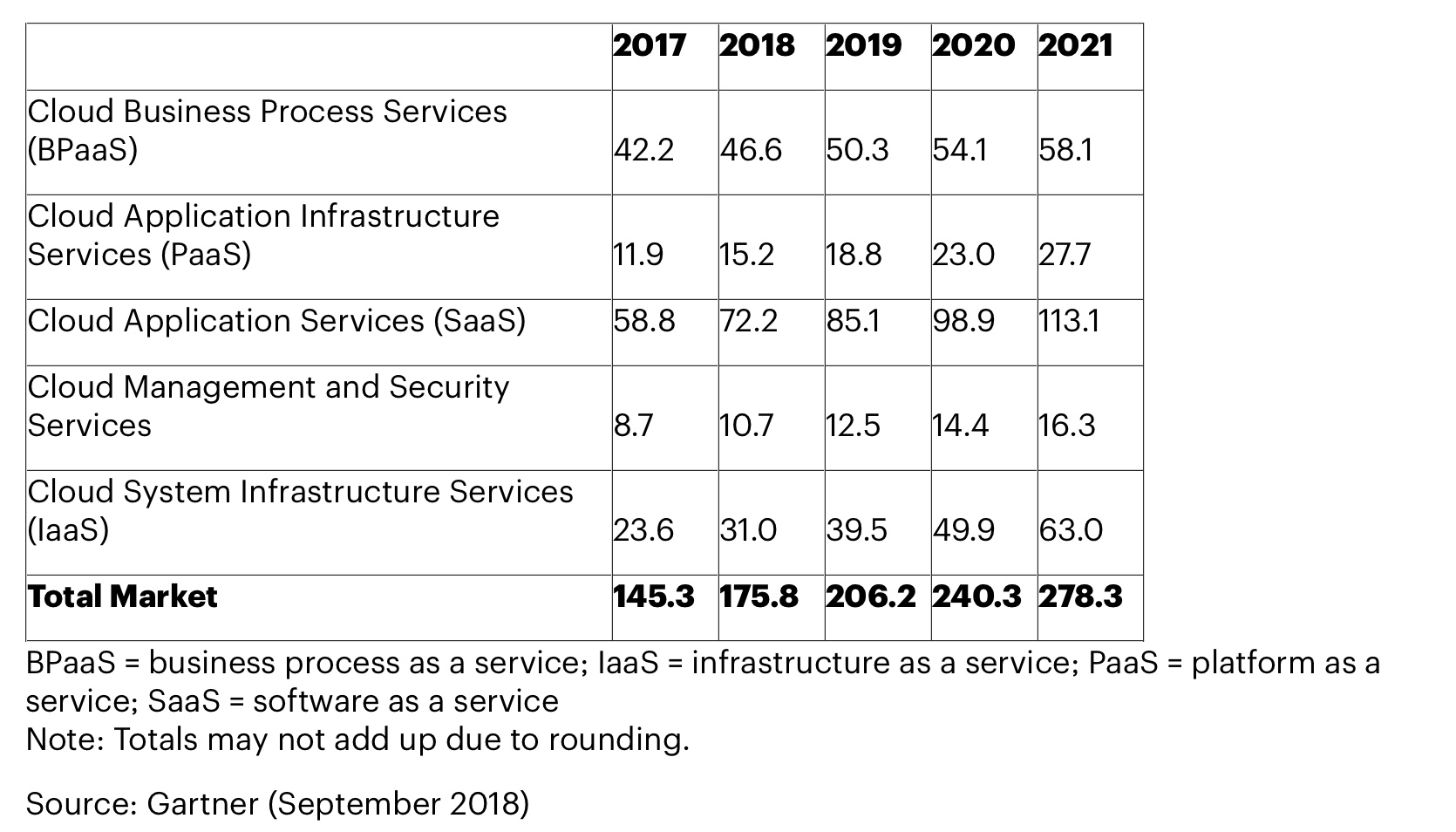

The worldwide public cloud services market is projected to grow 17.3% in 2019 to total $206.2 billion, up from $175.8 billion in 2018, according to Gartner, Inc. (www.gartner.com). In 2018, the research group forecasts that the market will grow 21%, up from $145.3 billion in 2017.

The fastest-growing segment of the market is cloud system infrastructure services (infrastructure as a service or IaaS), which is forecast to grow 27.6% in 2019 to reach $39.5 billion, up from $31 billion in 2018.

By 2022, Gartner expects that 90% of organizations purchasing public cloud IaaS will do so from an integrated IaaS and platform as a service (PaaS) provider, and will use both the IaaS and PaaS capabilities from that provider.

“Demand for integrated IaaS and PaaS offerings is driving the next wave of cloud infrastructure adoption,” says Sid Nag, research director at Gartner. “We expect that IaaS-only cloud providers will continue to exist in the future, but only as niche players, as organizations will demand offerings with more breadth and depth for their hybrid environments. Already, strategic initiatives such as digital transformation projects resulting in the adoption of multicloud and hybrid cloud fuel the growth of the IaaS market.”

Software as a service (SaaS) remains the largest segment of the cloud market, with revenue expected to grow 17.8% to reach $85.1 billion in 2019.

“The increasing adoption of SaaS applications and other cloud services impacts the management, dissemination and exploitation of enterprise content,” says Craig Roth, research vice president at Gartner. “Organizations are steadily — but not exclusively — shifting their content environments to SaaS. Gartner expects that by 2019, the current enterprise content management (ECM) market will devolve into purpose-built, cloud-based content solutions and solution services applications.”

In the business process as a service (BPaaS) category, Gartner forecasts a revenue growth of 7.9%, to reach $50.3 billion in 2019. Gartner found that especially in this category, buyers increasingly expect deep domain expertise, technology and global deployment capabilities from their providers as well as service portfolios that bridge legacy offerings and support new automated, digital and cloud service delivery paradigms.