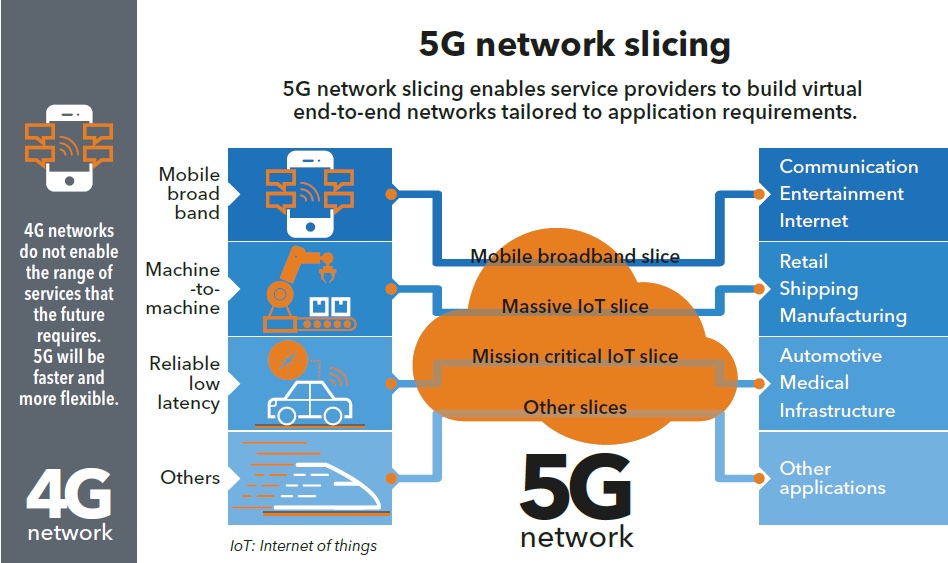

Physical industries are rapidly transforming on an unprecedented scale with digitization becoming a critical priority. End-to-end 5G network slicing is promised to be a growing part of that transformation but mobile service providers must change all aspects of their business before they address it, according to ABI Research (www.abiresearch.com).

The analysis firm forecasts that network slicing stands to create approximately US$66 billion in value for enterprise verticals including manufacturing, logistics, and transportation by 2026.

5G network slicing has become the focus of much attention in part due to its intrinsic ability to afford flexibility and dedicated resources tuned to different industrial use cases. Legacy networks and wired technology dominate in the fragmented industrial environment of today, a rigid arrangement that is not conducive to high productivity levels.

“Industrial segments such as manufacturing, logistics, and automotive are pursuing digitalization and automation with vitality and substantial investments. 5G network slicing aims to serve as a stepping stone to drive productivity growth and enable the high-performance connectivity that underpins the dynamic, secure, and reliable interconnection of industrial systems and machinery,” says Don Alusha, senior analyst at ABI Research.

Despite illustrating substantial growth in the coming years and reaching US$66 billion by 2026, network slicing revenues will be a mere 6% of total mobile service provider consumer revenues during the same year. Alusha says that making this a much bigger opportunity and one that provides major growth prospects will require mobile service providers stepping out of their comfort zone.

They will need to radically improve their marketing messages to enterprise verticals, they will need to change their terminology and language to their B2B clients, the will need to invest in proof of concepts in previously unexplored areas, they will need to engage in new brand partnerships and finally, they will need to invest in creating customized solutions for enterprise verticals.

The adoption of 5G network slicing for manufacturing alone is expected to create a $32 billion of value, at a compound annual growth rate (CAGR) of 96% through 2026. ABI Research says the second biggest revenue opportunity lies in the logistics sector, where the market is projected to increase from $65 million in 2019 to US$20 billion in 2026, at a CAGR of 127%.

“Our projections point to a healthy growth outlook but except for Telefonica, BT, and Deutsche Telekom, there is not much market activity of substance. The MSP ecosystem extends beyond this trio of operators, so we anticipate the wider community to start addressing enterprise verticals and entering an exploration phase in the coming years,” Alusha adds.

Graphic courtesy of SDxCentral