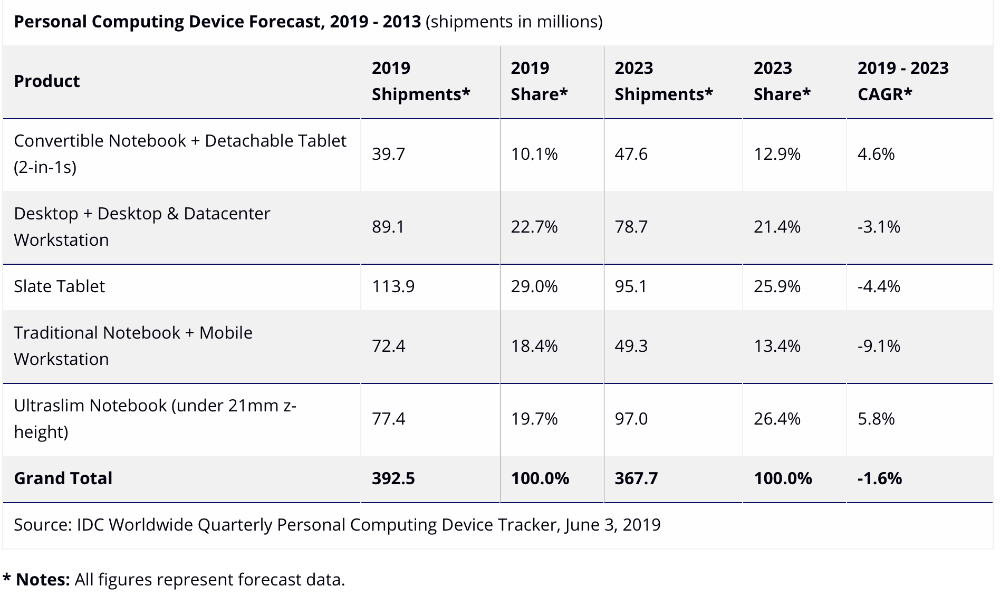

The worldwide market for personal computing devices (PCDs), inclusive of traditional PCs and tablets, is expected to decline 3% in 2019 with shipments reaching 392.5 million units, according to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

The research group anticipates the decline to continue through 2023 with unit shipments reaching 367.7 million and a compound annual growth rate (CAGR) of -1.6%.

Despite the long-term decline, 2019 is shaping up to be an interesting year as the dollar value of the market will remain roughly flat at $237 billion amid a unit decline. Average selling prices (ASPs) for the entire market are expected to rise by 2.6% in 2019 driven by new technologies, such as thinner bezels on notebook screens that have increased demand for 2-in-1 form factors, and ongoing demand for gaming PCs. Additionally, shipments into the commercial segment are expected to provide an uplift in ASPs in 2019 as many enterprises move to replace their PCs before Microsoft ends support for Windows 7 in early 2020.

“Many enterprises are also looking to modernize their workforce by deploying ultraslim notebooks and 2-in-1 form factors,” Jitesh Ubrani research manager for IDC Mobile Device Trackers. “Not only are these devices expected to mobilize the workforce, but providing more brand and form factor options has proven successful at bringing younger talent into the work force.”

The consumer side of the market will remain challenged with shipments expected to decline 6% year over year in 2019 and throughout the five-year forecast with a CAGR of -2.7%. Traditional notebooks and slate tablets will continue to pull the segment down as consumers have migrated to newer, thinner form factors that often include some sort of 2-in-1 option.

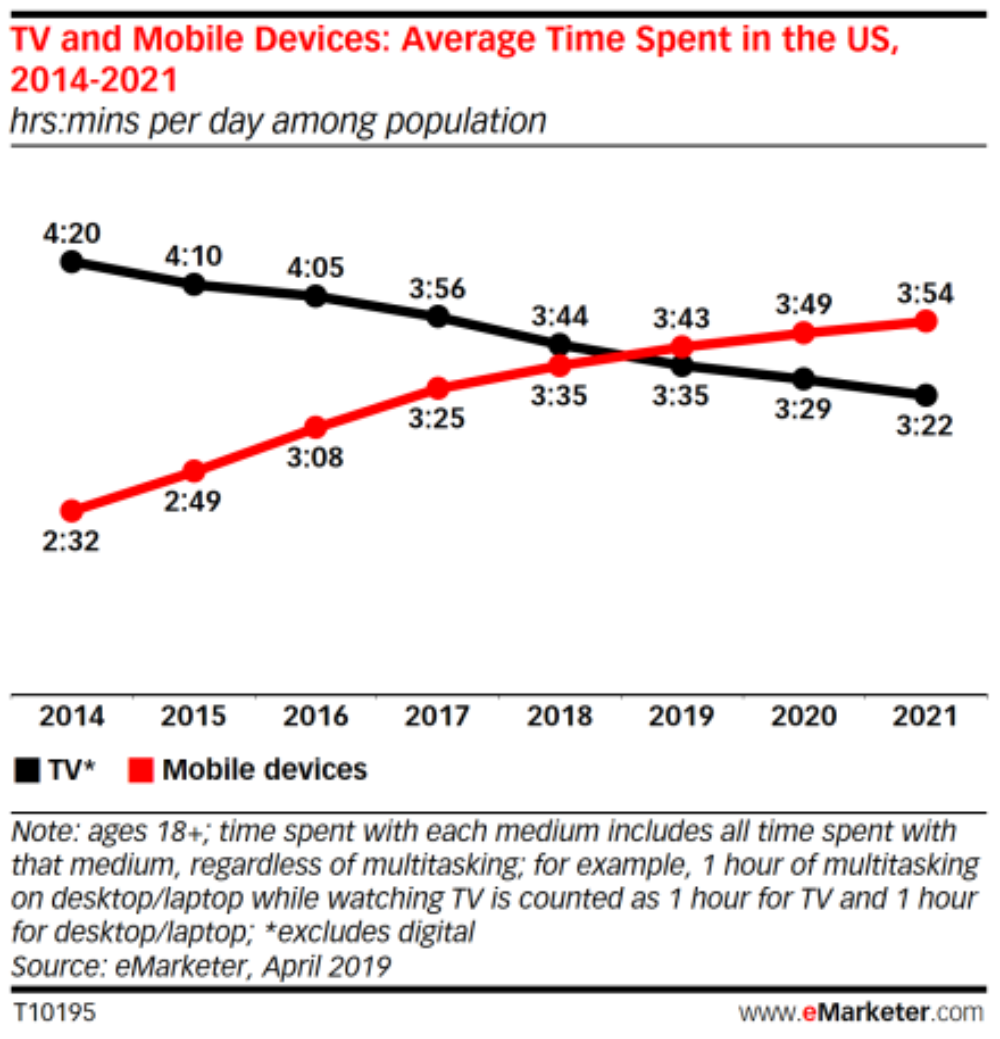

“Both the PC and tablet market have encountered numerous challenges in recent years when it comes to consumer growth,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Smartphones continue to be top of mind for consumers when it comes to new device purchases, and arguably the rapid adoption of large screen smartphones has resulted in consumers doing less on their PC or tablet and more on their phone. Looking ahead, the areas we are watching for consumer growth are a broader range of gaming PCs, including lower-priced options, as well as thin and light notebooks at more attractive price points.”