The global market for smartphone memory chips reached a combined value of US$39.3 billion in calendar year (CY) 2019, according to the Strategy Analytics Handset Component Technologies service report, “Smartphone Memory Market Share Q4 2019: Revenue declines as Samsung leads the NAND Flash and DRAM markets.”

According to the report, Samsung Memory maintained its smartphone memory market share leadership with 47% revenue share in CY 2019, followed by SK Hynix and Micron. Samsung continued to strengthen its position in both NAND Flash and DRAM markets. The top-three vendors captured almost 84 percent revenue share in the global smartphone memory market in CY 2019.

NAND Market

The total NAND Flash revenue for smartphones witnessed a decline of 29% year-over-year owing to the slowdown in the market demand in CY 2019. The market was dominated by Samsung Memory with a revenue share of 42% followed by Kioxia and SK Hynix, each having a share of 22% and 16%, respectively, in the smartphone NAND flash market in 2019.

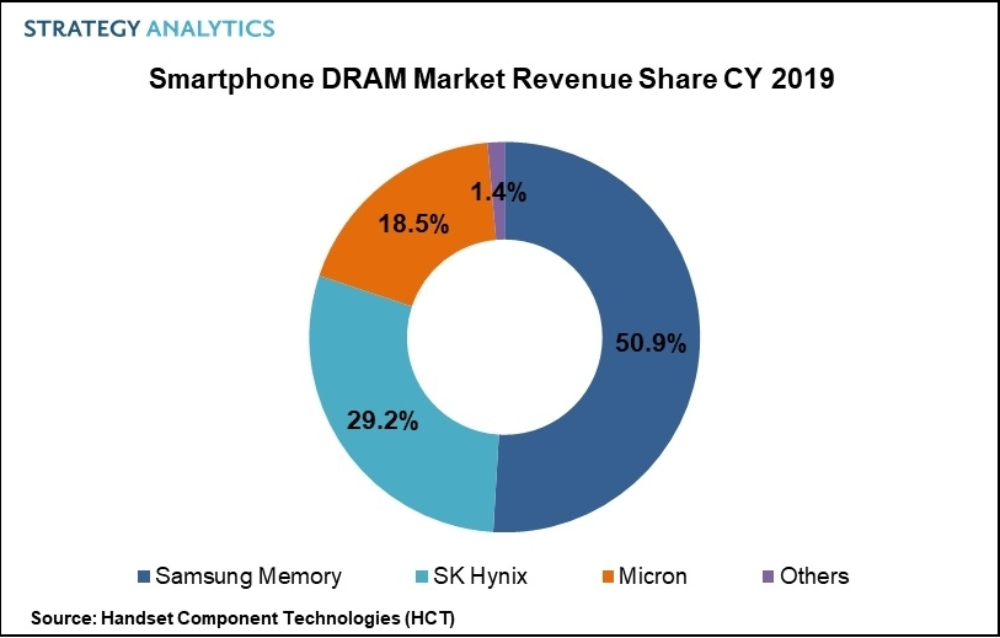

DRAM Market

In CY 2019, the overall DRAM market revenue for smartphones recorded a decline of 27% year-over-year due to the fall in demand and pricing challenges. In terms of vendor share, Samsung Memory registered a revenue share of 51% followed by SK Hynix with 29% and Micron with 19% share.

“In CY 2019, the memory market observed a decline in revenue owing to seasonality and existing oversupply in the market that lead to a fall in memory chip prices,” Jeffrey Mathews, analyst at Strategy Analytics says. “Samsung Memory registered successful design wins with major smartphone original equipment manufacturere for its NAND Flash and DRAM memory chips in CY 2019 which drove its revenue. The increase in the demand for eMMC and UFS based Multichip Packages contributed in the chip shipments for Samsung Memory and SK Hynix in CY 2019.”