Apparently, the Goldman Sachs bank wants out of its consumer lending deal with Apple as soon as possible.

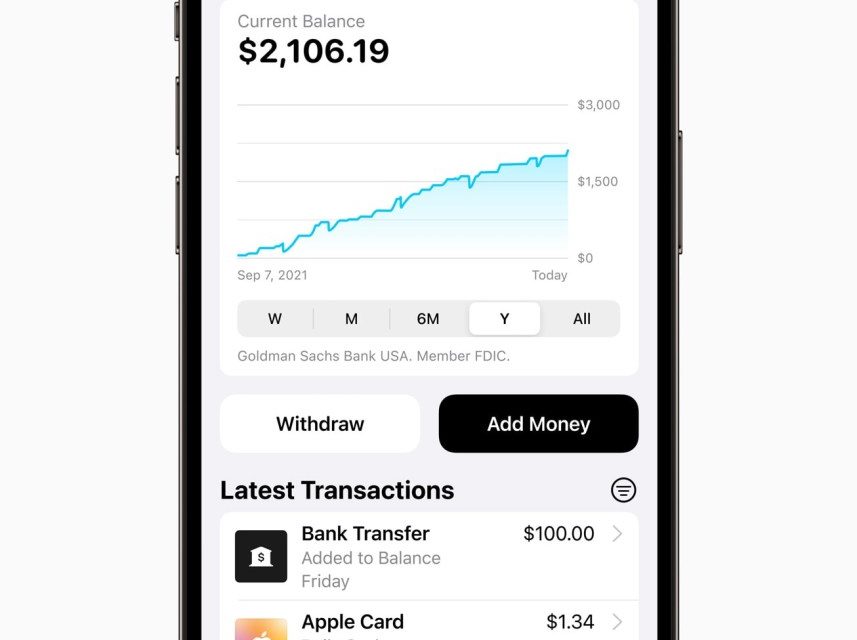

When Goldman Sachs and Apple launched their joint savings account in April, Goldman held a town hall at its headquarters, where bank execs talked it up. However, one exec had a different message shortly afterwards: “We should have never done this f___king thing,” he told colleagues, according to The Wall Street Journal (a subscription is required to read the article).

The WSJ says some Goldman Sachs executives have proposed that Apple itself take on more of the venture. For example, Apple could take new card users, while Goldman Sachs maintains current ones. However, neither Goldman Sachs nor Apple have had serious discussions about such a move (yet), the article adds.

Goldman went public with plans to scale back its consumer business late last year, but it appeared committed to Apple. In fact, in August 2022, Apple Card and issuer Goldman Sachs again topped the charts in the Midsize Credit Card Issuer segment of the annual J.D. Power U.S. Credit Card Satisfaction Study for the second year in a row.

Introduced in 2019, the Apple Card was built with customers’ financial health in mind, according to Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. It has no fees and is designed to offer customers an easy and secure way to track purchases, and manage spending from Wallet, while getting up to 3% Daily Cash when they use Apple Card online, in-store, and in-apps, she adds.

Article provided with permission from AppleWorld.Today