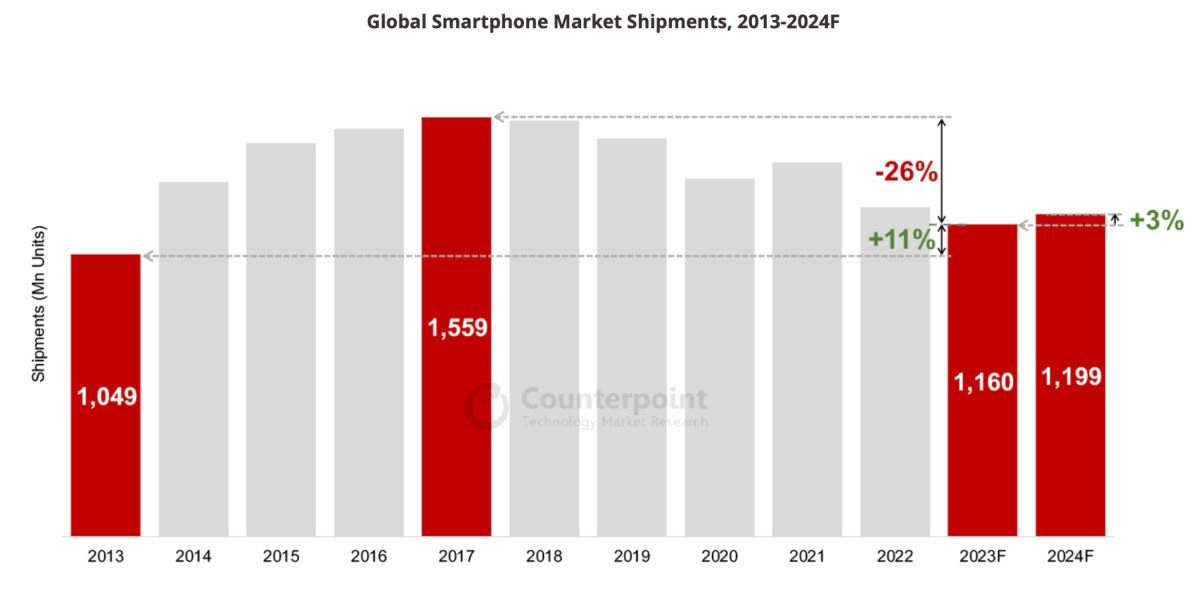

Global smartphone shipments in 2023 are projected to decline 5% year-over-year (YoY) to reach 1.2 billion, the lowest level in almost a decade, according to Counterpoint Research’s Smartphone 360 Global Smartphone Shipment Forecast.

However, the shipments are expected to increase by 3% YoY in quarter four (Q4) 2023 to reach 312 million units. And it’s (kinda) good news for Apple.

Counterpoint says that the iPhone 15 Pro series’ share in the overall iPhone 15 series is projected to increase to 65% in Q4 2023. The research group adds that India will become Apple’s new growth focus, but the brand’s underperformance in China will hinder its growth in 2024.

North America (NAM) and Europe’s shipments are expected to remain stagnant in Q4. But China and emerging markets such as the Middle East and Africa (MEA) and India have managed to break out from their declines and will recover to become the new drivers of growth in the smartphone market from Q4 2023 onwards, Counterpoint predicts.

Apple, the usual market leader in Q4 with its newly launched series, is expected to record a volume decline of 3% YoY in Q4 2023, mainly due to Huawei’s aggressive expansion in China and prolonged delay in smartphone upgrades in Japan. However, Apple will try to offset the underperformance in volume terms by growing in value terms with a better product mix.

In Q4 2022, the shipment share of the iPhone 14 Pro series in the entire iPhone 14 series was 61%. In Q4 2023, however, the iPhone 15 Pro series’ portion in the iPhone 15 series is projected to increase to 65%.

Counterpoint says Apple will be just in line with the market growth in 2024 while facing pressures in its traditional markets. The retention of high interest rates in the US, which hit consumer spending, and intensifying competition in China’s premium smartphone market, mainly due to Huawei, are expected to hinder the iPhone’s growth throughout 2024.

Article provided with permission from AppleWorld.Today