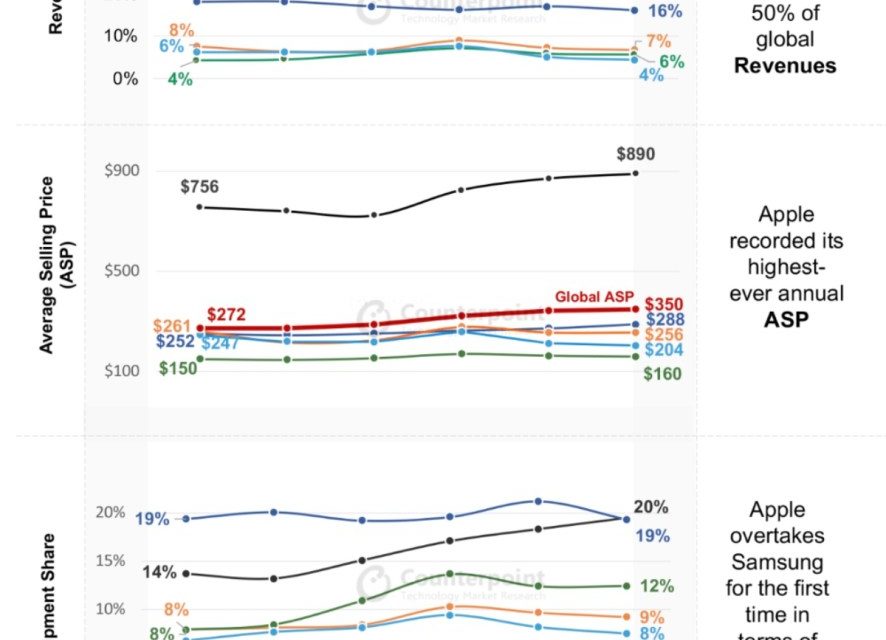

A new report by Counterpoint Research says that global smartphone market revenues declined by 2% to a little under US$410 billion in 2023 compared with a 4% decline in shipments to 1.17 billion units.

This is thanks to a 2% growth in global smartphone ASPs [average selling price] which touched $350 for the first time. Apple led the market with a 50% share of global smartphone revenues, its highest-ever for a full year. This contributed to the ongoing premiumization trend with one in every four smartphones shipped in 2023 wholesaling for more than $600.

Consequently, while the non-premium segments experienced double-digit declines, premium smartphone shipments grew by 8% driven by foldables, features like GenAI, and, of course, Apple, according to Counterpoint.

Commenting on Apple’s performance in 2023, Research Director Jeff Fieldhack noted: “Apple displaced Samsung as the biggest player in shipments for the first time in a full year. While the US made the biggest volume contribution to Apple’s growth, it also received a major boost through double digit growth in emerging markets including India, Caribbean and Latin America (CALA) and Middle East and Africa (MEA). This growth offset any challenges Apple may have faced in China due to the resurgence of Huawei. With an accompanying ASP growth of 2%, it can be seen to be in a revenue super cycle, buoyed by its ecosystem stickiness coupled with the premiumization trend, crossing an annual revenue of $200 billion.”

Elaborating on Apple’s performance in China, Counterpoint Senior Analyst Ivan Lam said, “The positive emerging market offset is a welcome news, but China remains a slight concern. The market’s recovering but Apple is facing competition from a resurgent Huawei in the premium segment and multiple China OEMs digging into iPhone 13 and 14 volumes. We’ll see whether Apple will get aggressive on pricing over the critical weeks before Chinese New Year and how this correlates to volume increases.”

Article provided with permission from AppleWorld.Today