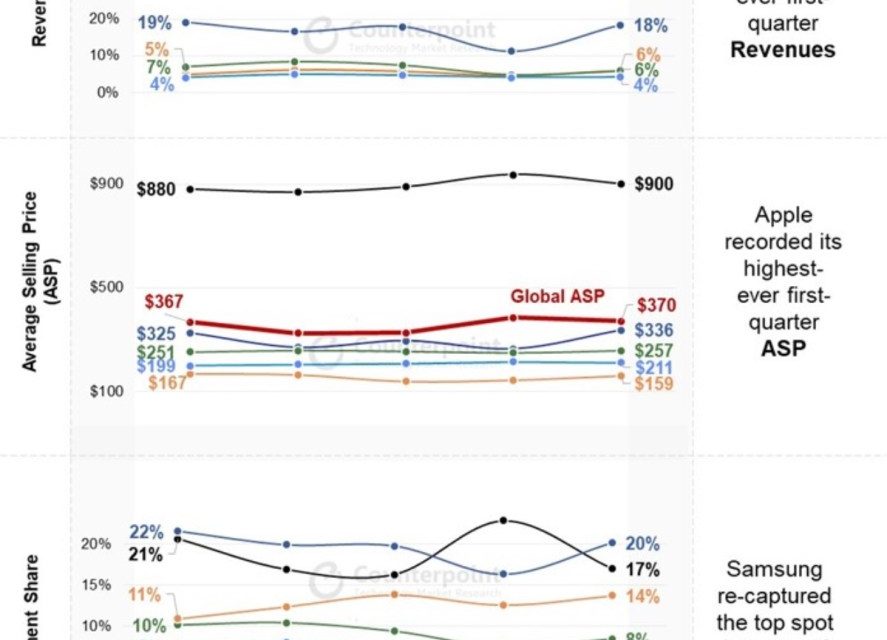

The global smartphone market grew by 6% year-over-year (YoY) to reach 296.9 million unit shipments in quarter one (Q1) of 2024, according to new data from Counterpoint Research.

Samsung dethroned Apple to become the top smartphone player globally, accounting for 20% shipment share. The iPhone maker’s shipments declined 13% YoY due to high inventory build-up during the last quarter. However, the brand’s average selling price (ASP) grew 2% YoY.

Most of the global smartphone growth comes from key regions such as Europe, Middle East and Africa (MEA) and Caribbean and Latin America (CALA), according to Counterpoint. Worldwide smartphone revenues grew by 7% YoY in Q1 2024 and reached the highest-ever in a first calendar quarter.

The >$800 price segment was the fastest growing, registering double-digit growth and accounting for 18% of smartphone shipments in Q1 2024, up by two percentage points compared to Q1 2023.

Apple led the smartphone market revenues with a 43% share, although its revenues declined by 11% YoY. Samsung’s revenues grew 2% YoY, propelled by its increasing ASP while shipments remained flat.

Commenting on Apple’s performance, Counterpoint Research Director Jeff Fieldhack said, “Tough competition in China, record low upgrades in the US and a difficult compare from last year due to iPhone 14 Pro’s supply shifting to Q1 2023 all weighed on iPhone performance. However, there were upsides as well. An improved product mix with 15 Pro’s performing better than its predecessors, and an increasing footprint in emerging markets, helped Apple in arresting some of the declines. Emerging markets especially provide long term growth opportunities. We also expect the inclusion of GenAI later this year to contribute to iPhone upgrades.”

Article provided with permission from AppleWorld.Today