Canalys’ latest research reveals that Mainland China’s smartphone market shipped 285 million units in 2024, marking a recovery after two years of decline with moderate year-on-year growth of 4%.

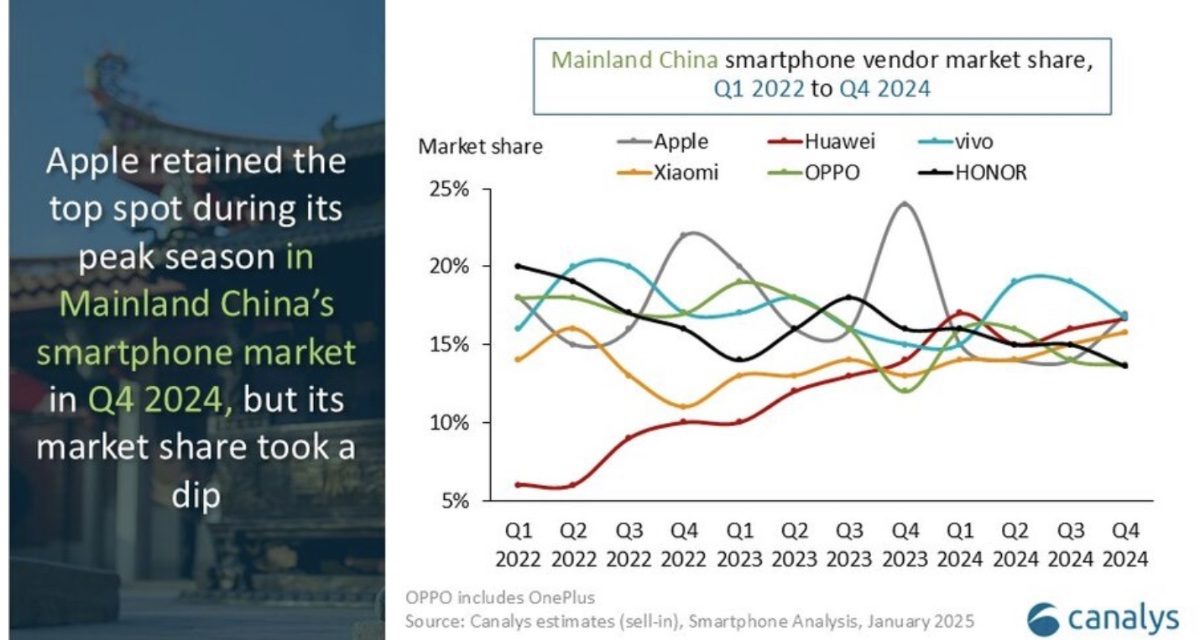

Apple retained the top spot during its peak season in Mainland China’s smartphone market in the fourth quarter (Q4) of 2024, but its market share took a dip.

China-based vivo led the market for the year with a 17% market share, shipping 49.3 million units. Huawei, also based in China, ranked second with 46.0 million units shipped.

Apple, OPPO and HONOR followed in third, fourth, and fifth place respectively, each holding a 15% market share. The latter two companies are also based in China. In Q4 2024, driven by the high-end peak season, government subsidies and year-end promotions, the Mainland China smartphone market grew by 5% year on year, with shipments reaching 77.4 million units. Apple shipped 13.1 million units in its traditional peak season in the quarter, retaining the top spot. However, its shipments dropped by 25% year-on-year.

vivo and Huawei followed closely, both capturing 17% of the market and ranking second and third, respectively. Xiaomi ranked fourth in Q4 2024 with 12.2 million units shipped, achieving the highest annual growth among the top vendors at 29%. OPPO ranked fifth with 10.6 million units shipped, achieving a year-on-year growth of 18% in Q4.

“Apple and its iPhone 16 series maintained the top spot in Q4 but faced growing competitive pressure from domestic flagship devices,” says Canalys Research Manager Amber Liu. In addition to driving sales through seasonal promotions, Apple is enhancing its high-end competitiveness and user retention by improving retail experiences through channel management, offering trade-in programs and expanding coverage of interest-free installment plans.”

I hope you’ll help support Apple World Today by becoming a patron. Patreon pricing ranges from $2 to $10 a month. Thanks in advance for your support.

Article provided with permission from AppleWorld.Today