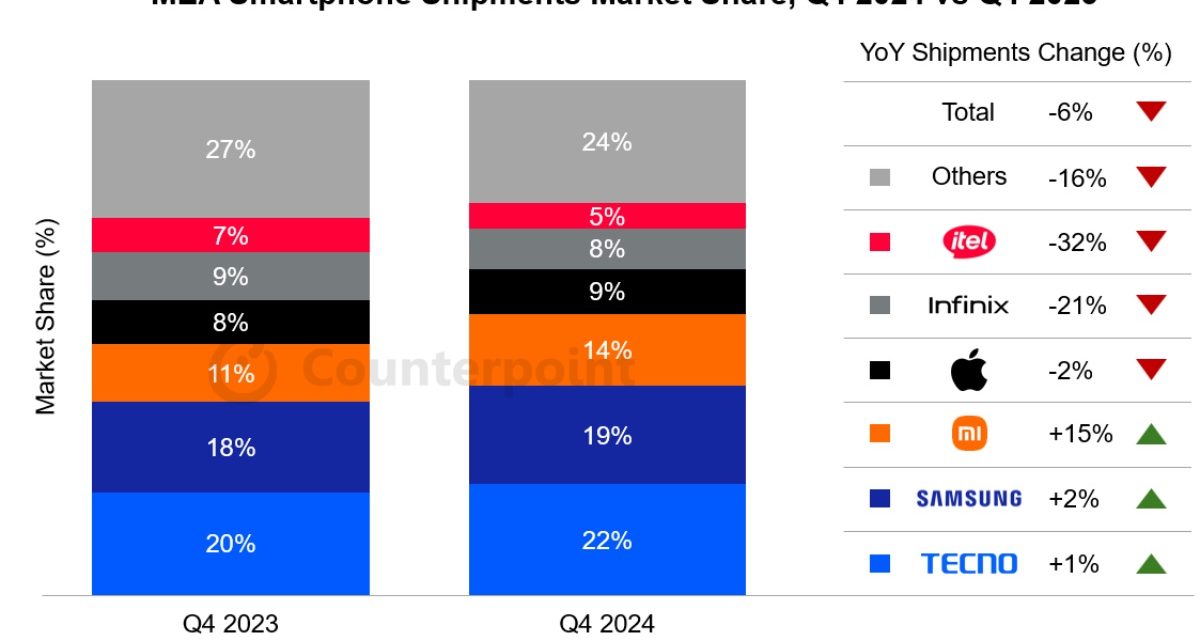

Smartphone shipments in the Middle East and Africa (MEA) region fell 6% year-over-year (YoY) in Q4 2024, according to Counterpoint’s latest Market Monitor Service report.

This marks the region’s second consecutive quarter of YoY declines, as festive sales failed to offset lingering inventory and economic challenges. Additionally, the strong performance in the year-ago period made YoY comparisons difficult.

The average selling price (ASP) of smartphones rose 7% YoY in Q4 2024, as more consumers shifted towards higher-end ($400-$700) and ultra-premium (>$1,000) models. Apple and Samsung benefitted the most from this trend, according to Counterpoint.

Apple’s shipments fell 2% YoY in Q4 2024. However, the brand’s market share advanced to 8.8%, up 0.4% YoY. Strong demand for the iPhone 16 and 15 series was offset by weaker sales of older models. Apple focused on trade-in programs, financing options, and carrier partnerships to sustain demand. It also expanded retail availability and leveraged events like the Dubai Shopping Festival to boost sales.

Counterpoint says buyers prioritized 5G, enhanced cameras, and smoother displays, while demand for budget LTE smartphones declined. Meanwhile the mid-range segment shrank, as consumers either upgraded to more advanced models or held on to their current devices.

5G adoption grew rapidly, especially in budget-friendly models ($100-$150), as brands actively pushed 5G-enabled devices amid a decline in component prices. Brands also focused on faster charging, AI-powered cameras, and more durable designs to attract buyers. Early trends indicate that MEA consumers have embraced 5G devices enthusiastically, despite the limited availability of 5G networks,Counterpoint says.

I hope you’ll help support Apple World Today by becoming a patron. Patreon pricing ranges from $2 to $10 a month. Thanks in advance for your support.

Article provided with permission from AppleWorld.Today